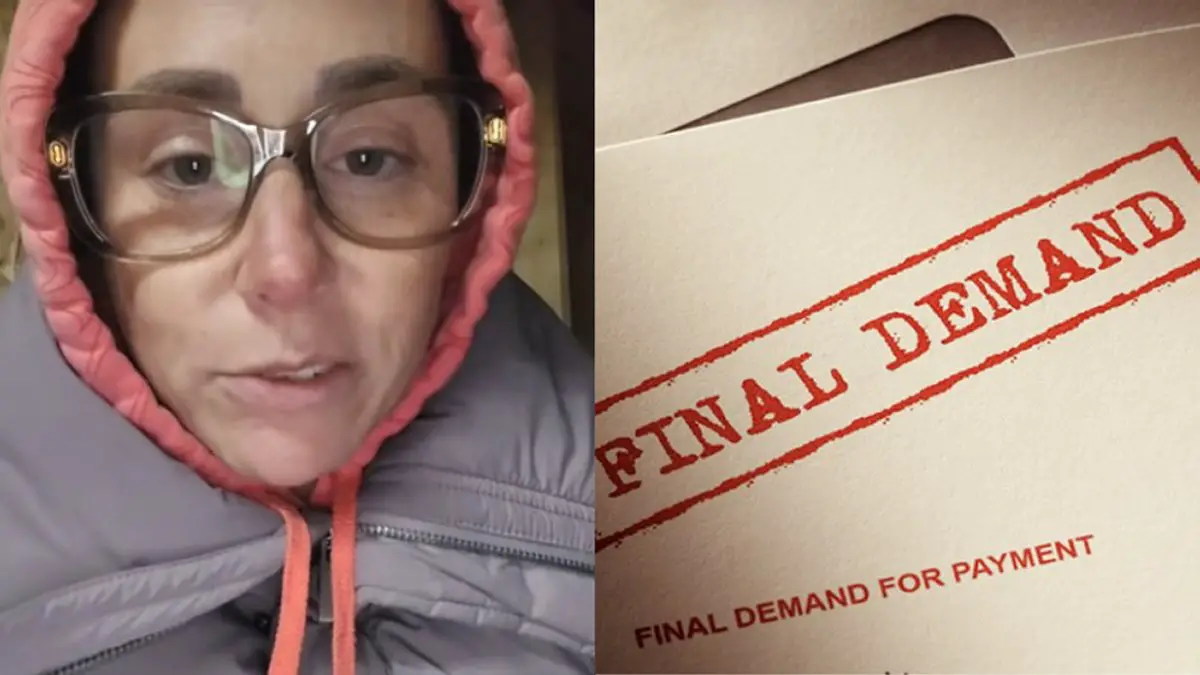

Sometimes life throws a curveball, and for one Michigan resident, it came in the form of relentless debt collection. Timed perfectly just before the holidays. Instead of quietly paying or negotiating, she decided to fight back on her own terms. While many might admire her audacity, her approach raises deeper questions.

The woman, known online as Jenni, or becca.ridge on TikTok, had recently been laid off and faced mounting credit card debt with little income to cover it. When a debt collector sent a summons before Christmas, she defiantly told them, “Sue me,” fully aware the legal system could, and likely would, pursue the money owed.

And pursue they did. But Jenni was ready, consulting with a lawyer to explore her options, while maintaining her stance that the collector’s tactics were deliberately cruel, exploiting the distracted holiday season.

While this Michigan woman’s boldness is undeniable, it’s worth asking. Is it morally right to ignore debts entirely, especially when others are counting on that money to be repaid? Critics might argue that while her fight against predatory practices is understandable.

Or outright defiant without considering the broader ethical impact could be seen as self-serving. After all, debts aren’t just numbers. They represent contracts and obligations that affect lenders, employees, and other stakeholders.

The Need To Protect Yourself Without Crossing Lines

Jenni’s approach, though empowering, is not without danger. Ignoring debts or openly challenging collectors without a solid legal strategy could lead to judgments, wage garnishments, and growing interest fees.

Her credit score could take a hit, impacting loans, housing, and future financial opportunities. Boldness is admirable, but when morality and law intersect, careful navigation becomes critical. Financial experts say, if you find yourself targeted by aggressive debt collectors, it’s crucial to act strategically.

Respond promptly to legal notices, consult a lawyer before making decisions, and document all communications. This way, you can stand up for yourself without creating legal or moral liabilities that could spiral out of control.

“All I’m hearing is, ‘yes, I owe the money, but I don’t care and won’t pay it,” snips one commenter.

“America 2025. Let someone else deal with my debt, student loans, and such,” one more states.

“My “opinion is that you always should fight it first before making any kind of deal,” the OP responds.

Jenni’s stand in Michigan is both inspiring and concerning. Her courage shows that it’s possible to push back against aggressive companies. However, it also raises important questions about ethics and responsibility. Standing up for yourself is one thing. But when defiance risks legal and moral trouble, strategy and self-reflection are essential.